schedule c tax form calculator

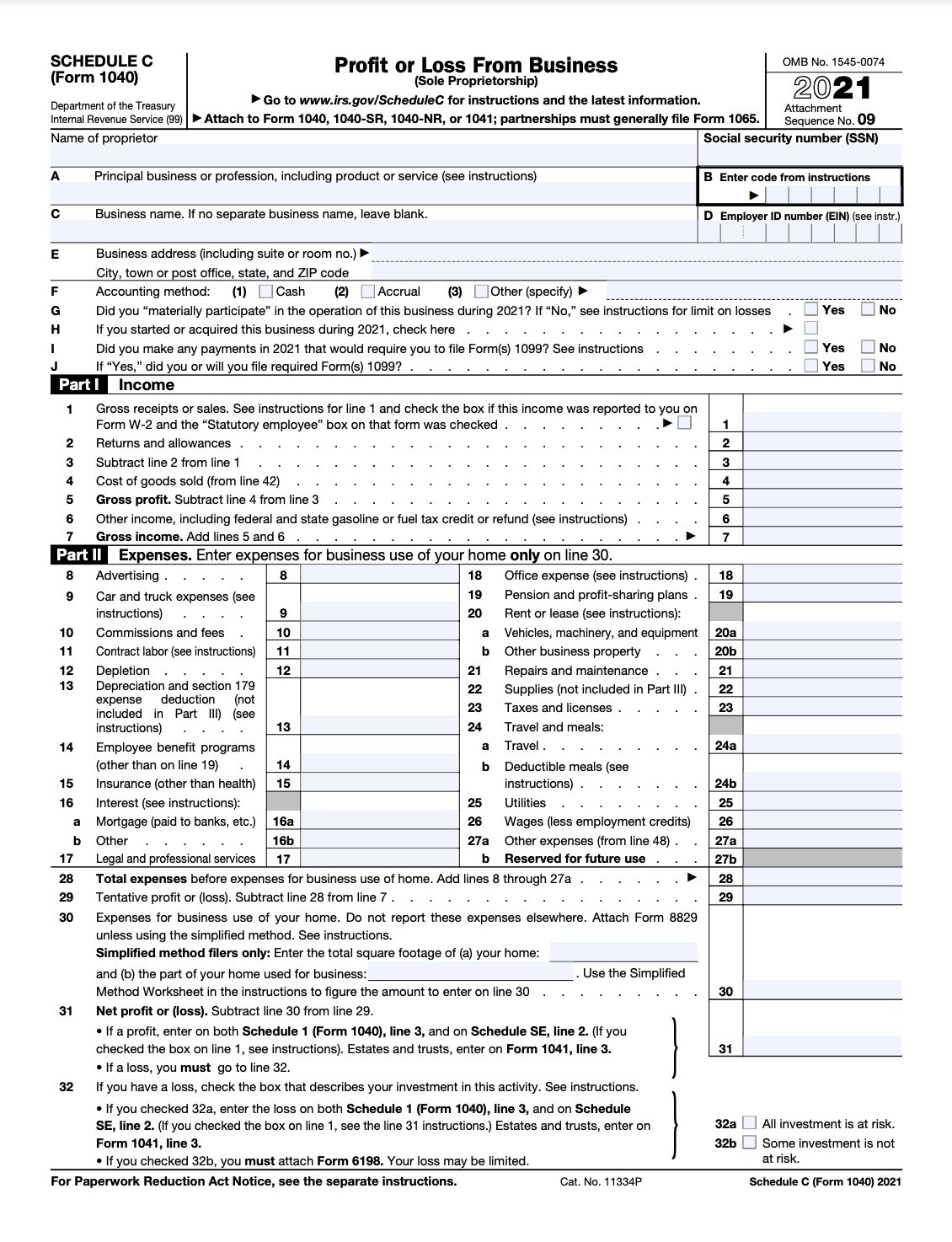

If you file using a software install our plug-in and well tell you the numbers you should enter at every step to prepare your taxes. You may also need Form 4562 to claim depreciation or Form 8829 to.

1099 Tax Calculator How Much Will I Owe

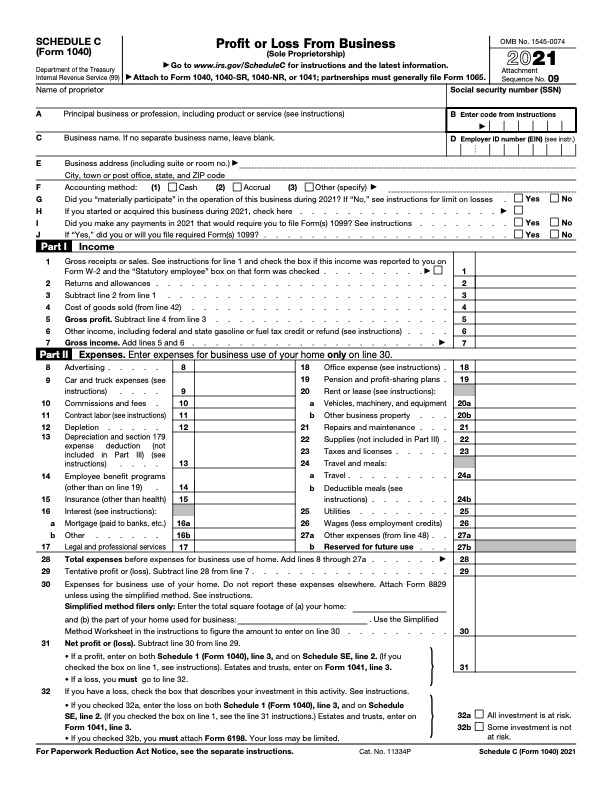

Go to line 32 31 32.

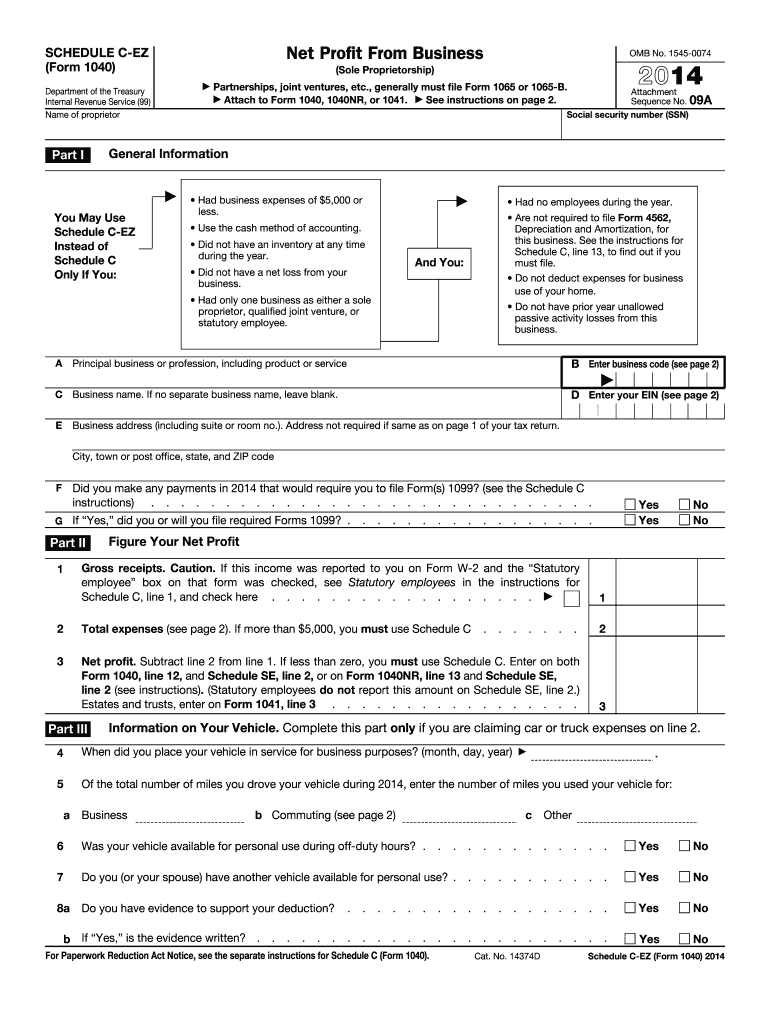

. If you checked 32a enter the. If you checked 32b. Use Tax Form 1040 Schedule C-EZ.

This is your total income subject to self-employment taxes. Were going to review this in detail below. Make tax season a breeze.

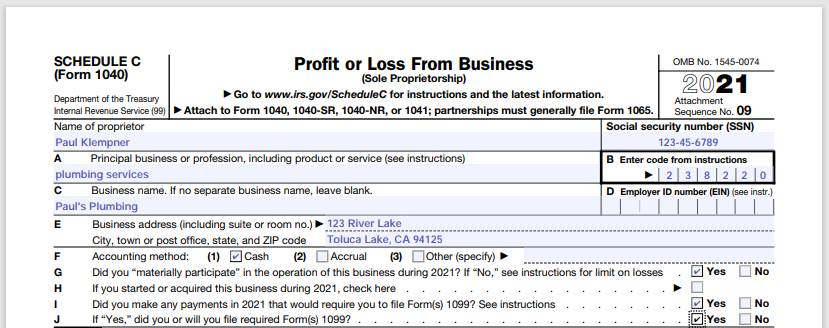

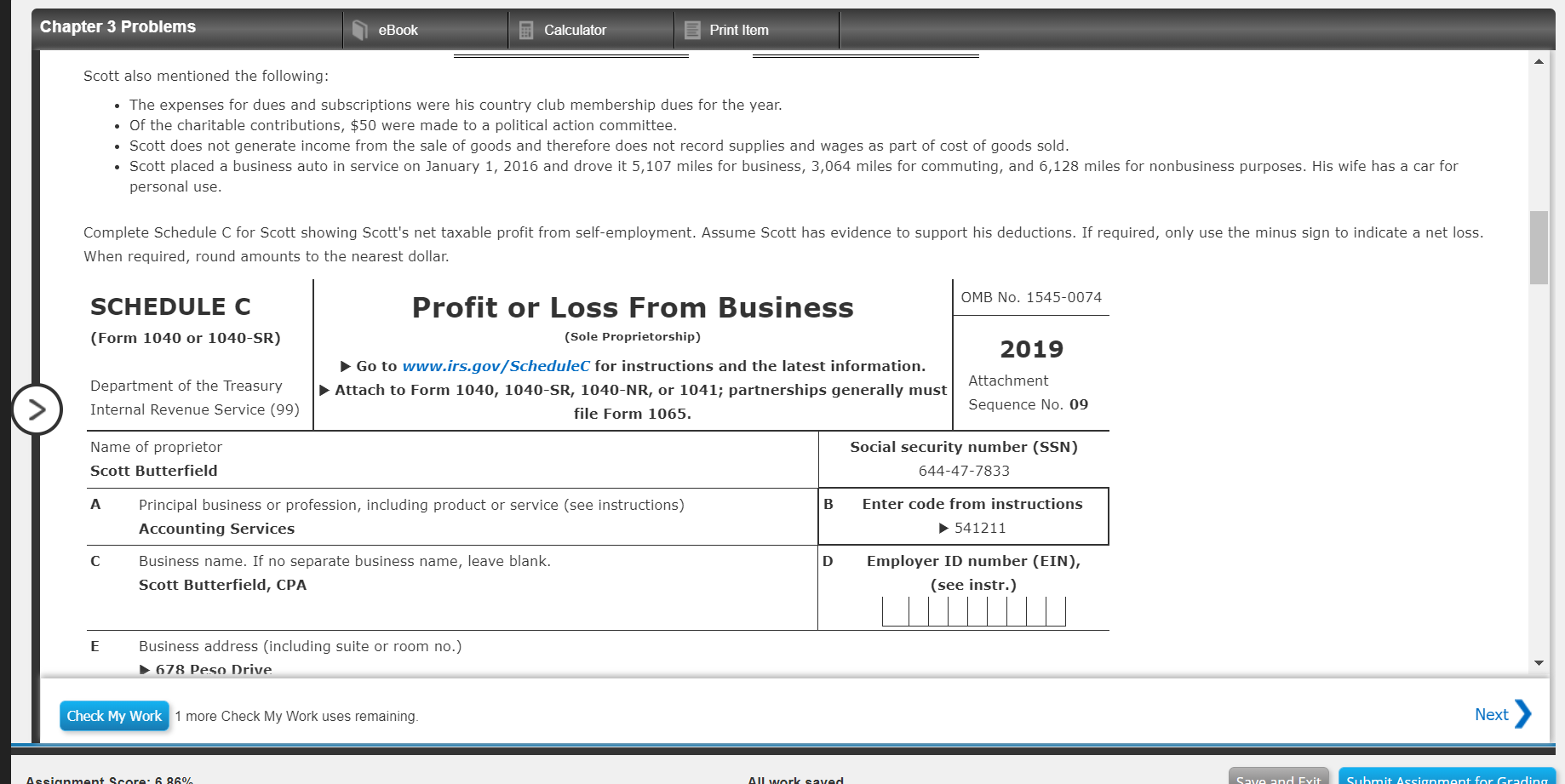

If you checked the box on line 1 see the line 31 instructions. Name of proprietor. The first section of the Schedule C is reserved for your business information.

However you can deduct one-half of your self. Online is defined as an individual income. The amount of unreimbursed business expenses from Form 2106 andor business expenses included on Schedule C must be adjusted for the percentage of tax-free income received ex.

For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income deductions and. Self-Employed defined as a return with a Schedule CC-EZ tax form. If you have a loss check the box that describes your investment in this activity.

This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. Use it to tell the government how much you made. Form 1040 Schedule C-EZ.

Net Profit from Business as a stand alone tax form calculator to quickly calculate specific amounts. Online is defined as an individual income. Based on your projected withholdings for the year we can also estimate your.

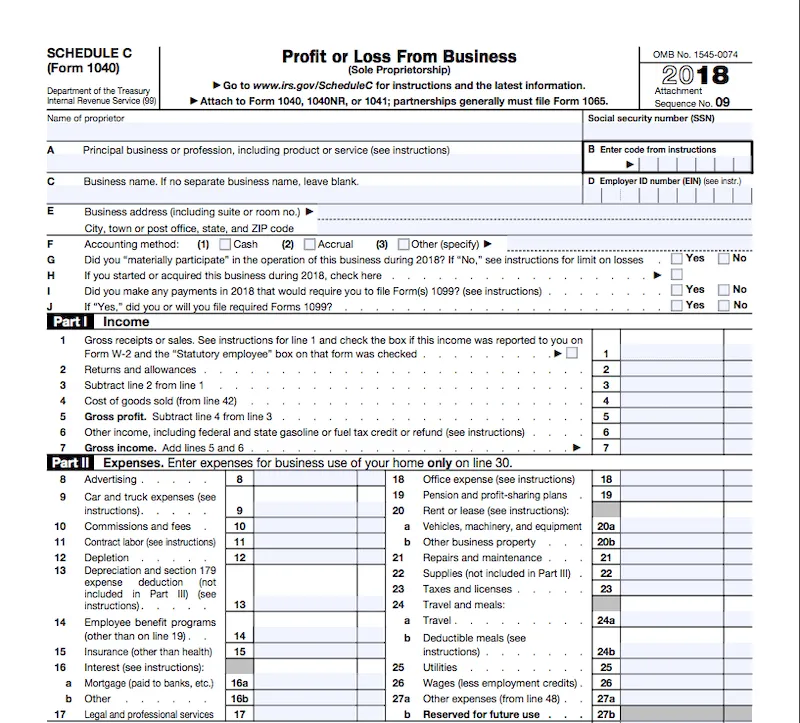

You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. Information about Schedule C Form 1040 Profit or Loss from Business. Online competitor data is extrapolated from press releases and SEC filings.

This is where Schedule C starts to look like a tax form rather than a straightforward information document. There are clear instructions in lines 3 5 and 7 but here. 1040 Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes.

Income Tax Return for Estates and Trusts. Up to 7 cash back The current rate of self-employment tax is 1530. About Form 1041 US.

Form 1041 line 3. Schedule C is typically for people who operate sole proprietorships or single-member. Usually people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Form.

Plan contributions for a self-employed individual are deducted on Form 1040 Schedule 1 on the line for self-employed SEP SIMPLE and qualified plans and not on the. Form 1041 line 3. A Schedule C is a tax form filed with your personal tax return that helps you calculate the profit or loss from your business.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Estates and trusts enter on. If a loss you.

If you have a tax advisor or. Schedule 1 Form 1040 line 3 and on. Schedule SE line 2.

This means that youll multiply your net earnings by 01530 to arrive at the amount of self-employment tax you need. Net Profit from Business. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Online competitor data is extrapolated from press releases and SEC filings. About Form 1099-MISC Miscellaneous Income.

How To Fill Out Your 2021 Schedule C With Example

Get Free Help Preparing Your Taxes

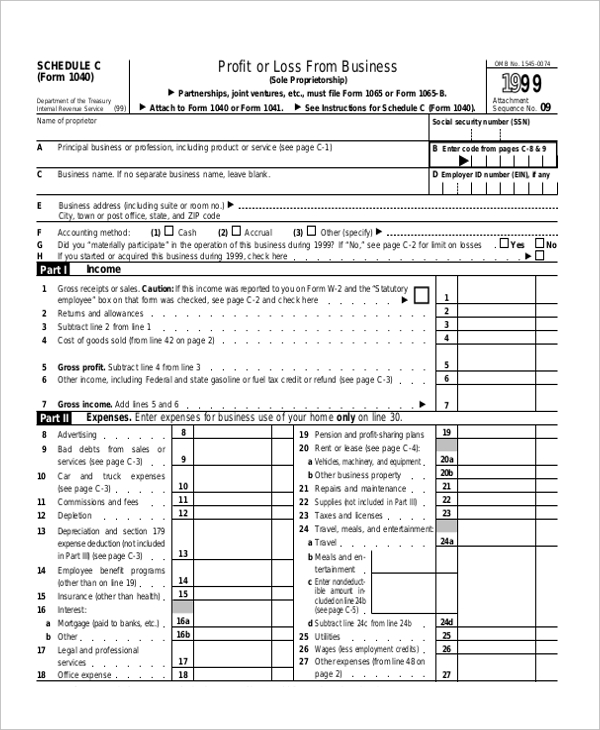

Free 9 Sample Schedule C Forms In Pdf Ms Word

The Schedule K 1 Form Explained The Motley Fool

How To Fill Out Your 2021 Schedule C With Example

Tax Calculator Estimate Your Taxes And Refund For Free

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

How To Fill Out Schedule C For Business Taxes Youtube

Tax Deduction For Legal Fees Is Legal Fees Tax Deductible For Business Agiled App

How To File Schedule C Form 1040 Bench Accounting

2014 Form Irs 1040 Schedule C Ez Fill Online Printable Fillable Blank Pdffiller

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Irs Forms Tax Forms Irs Tax Forms

Fill Out The Schedule C Form 1040 04 1040 Sr Using Chegg Com

American Tax 1040 Forms With Pen And Refund Check Us 100 Dollar Bills Stock Photo Alamy

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

2022 Tax Rate Card Doeren Mayhew Cpas

Llc Tax Calculator Definitive Small Business Tax Estimator

Is The Schedule 1099 C A Blessing Or A Curse Mi Money Health